Value-added tax (VAT) is a consumption tax that is levied on the supply of most goods and services in many countries. If you are registered for VAT, you are required to charge VAT on your taxable supplies of goods and services and you are entitled to claim back any VAT that you have paid on your business expenses.

There are several steps involved in registering for VAT, which may vary depending on the country in which you are operating:

- Determine if you are required to register for VAT: In most countries, VAT registration is only required if your taxable supplies exceed a certain threshold. It is important to check the VAT registration requirements in your country to determine if you are required to register.

- Choose a VAT accounting scheme: Depending on the country, you may have a choice of VAT accounting schemes, such as standard VAT accounting or the flat rate scheme. It is important to choose the right scheme for your business based on your specific circumstances.

- Register for VAT: To register for VAT, you will typically need to complete a VAT registration form and provide certain information about your business, such as your business name, contact details, and the nature of your business.

- Obtain a VAT registration number: Once you have registered for VAT, you will be issued a VAT registration number, which you will need to use when charging VAT on your taxable supplies and when claiming back VAT on your business expenses.

- File VAT returns: If you are registered for VAT, you will typically be required to file VAT returns on a regular basis, reporting the VAT you have charged and the VAT you have claimed back.

It is advisable to seek the advice of a professional tax advisor or a legal professional to ensure that you are complying with all relevant laws and regulations when registering for VAT.

VAT Registration in the UAE

In the United Arab Emirates (UAE), value-added tax (VAT) is a consumption tax that is levied on the supply of most goods and services. If you are conducting business in the UAE and your taxable supplies exceed AED 375,000 in a 12-month period, you are required to register for VAT.

To register for VAT in the UAE, you will need to follow these steps:

- Determine if you are required to register for VAT: As mentioned, VAT registration is only required if your taxable supplies exceed AED 375,000 in a 12-month period.

- Choose a VAT accounting scheme: The UAE offers two VAT accounting schemes: the standard VAT accounting scheme and the flat rate scheme. The standard VAT accounting scheme is based on the actual VAT paid or recoverable on business purchases and supplies. The flat rate scheme is a simpler option for small businesses, as it involves charging a fixed percentage of your taxable supplies rather than calculating the actual VAT paid or recoverable.

- Register for VAT: To register for VAT in the UAE, you will need to complete a VAT registration form and provide certain information about your business, such as your business name, contact details, and the nature of your business. You will also need to provide evidence of your taxable supplies, such as invoices or receipts.

- Obtain a VAT registration number: Once your VAT registration has been approved, you will be issued a VAT registration number, which you will need to use when charging VAT on your taxable supplies and when claiming back VAT on your business expenses.

- File VAT returns: If you are registered for VAT in the UAE, you will be required to file VAT returns on a regular basis, reporting the VAT you have charged and the VAT you have claimed back. VAT returns in the UAE are typically filed on a quarterly basis.

It is advisable to seek the advice of a professional tax advisor or a legal professional to ensure that you are complying with all relevant laws and regulations when registering for VAT in the UAE.

How to Apply for VAT Registration in UAE

To help you to complete VAT registration formalities successfully, we are bringing you the step-by-step process for applying for VAT registration.

Introduction

Applying for VAT Registration is a two-step process. First, you have to create an e-Services account and then you have to complete the VAT registration process.

- Creation of e-Service Account

- VAT Registration Process

Creation of e-Service Account

Before you proceed with online VAT registration, you have to create an e-Service account with FTA. The setting up of an online account in FTA is quite similar to the setting up of other online accounts like Gmail, Yahoo, etc. To create an account, you need to visit ‘https://eservices.tax.gov.ae’ and click the ‘Sign up’ option available on the right-hand corner of the screen. The following are the steps involved in creating an e-Service account.

- Click on Sign up and furnish the details such as e-mail Id, password, security code and security question in the sign-up form

- You will receive an email at your registered email address asking you to verify your email address

- Log in to your account with your credentials (User Name and password)

To know step-by-step details on how to create an e-service account, click here

VAT Registration process

To apply for VAT registration, you need to log in to your e-Service account using your login credentials. The step-by-step details on how to apply for VAT registration in UAE are given below.

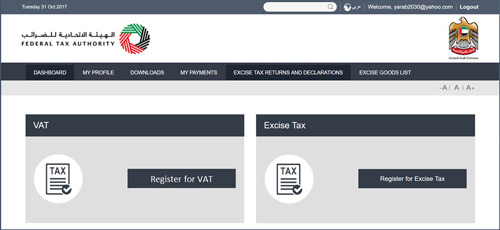

LOGIN TO YOUR E-SERVICE ACCOUNT

On logging into your e-Service account, you will be able to see the option ‘Register for VAT ‘as shown below:

To start the VAT Registration process, click on ‘Register for VAT’ available in your dashboard as shown in the above image.

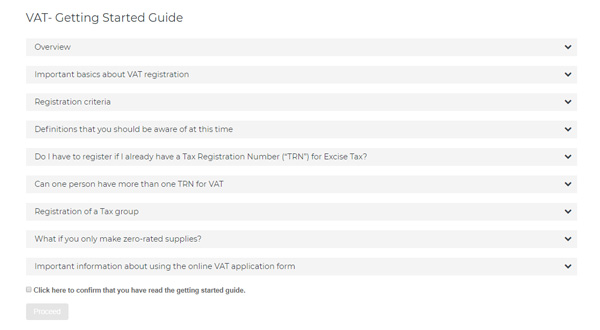

VAT GETTING STARTED GUIDE

After clicking ‘Register for VAT’, you will be navigated to the ‘Getting Started Guide’ as shown below:

This guide helps you understand certain important aspects of the VAT registration process in the UAE. It also provides the details on the information required for completing the VAT registration form. After reading the details in different sections of the guide, you need to tick ‘Click here to confirm you have read the getting started guide’ and click on ‘Proceed’.

VAT REGISTRATION FORM

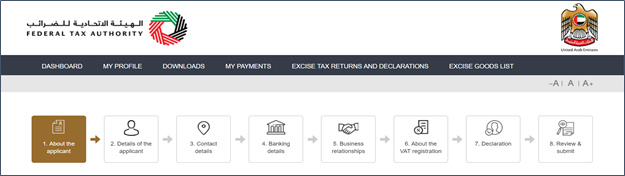

After reading the guide and clicking on ‘Proceed’, the VAT registration form will open as shown below:

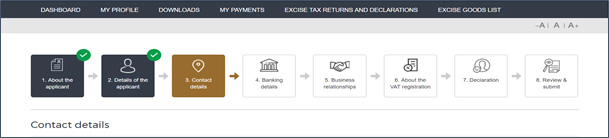

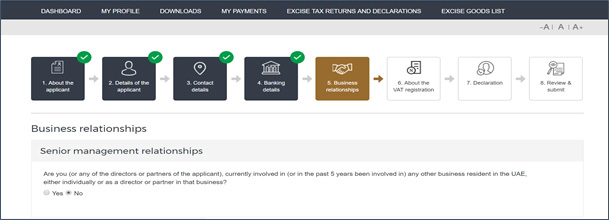

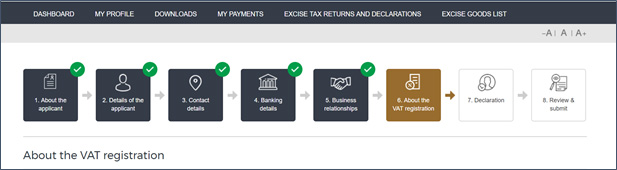

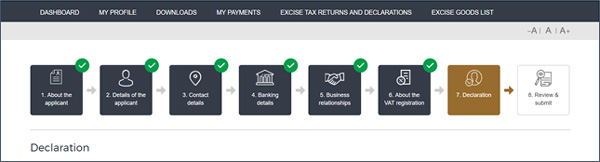

The VAT registration online form contains 8 sections under which details need to be furnished for completing VAT registration. The progress of VAT registration can be tracked by the applicant by the different colors indicator. The section which is in progress or in which you are updating the details, will be denoted by ‘Brown’ and the ones which are completed will be denoted by ‘Green’ with a tick mark as shown below:

The portal will allow you to move to the next sections only when details are captured in all the mandatory fields which are denoted by a red asterisk (*). If one or some of the mandatory fields are not captured, the portal is designed to alert you with a message indicating the relevant fields in which details must be captured.

Let us discuss the details to be captured in different sections of the online VAT registration form.

In this section, you need to capture the details about the person who is operating the business. In the ‘About the Applicant’ section, you need to capture the following details.

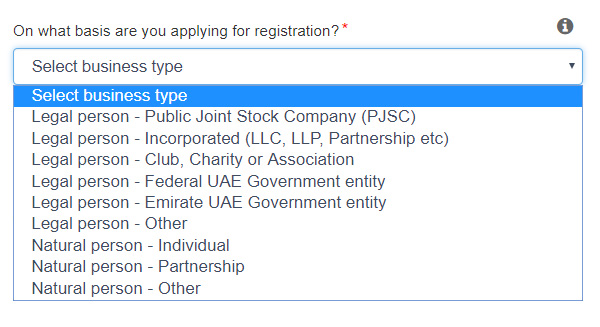

- On what basis are you applying for registration: Here, you need to mention the details of the person who is operating the business; whether he is an individual or a legal person or a natural person. All the options are available in the drop-down list as shown below, you have to just select the appropriate option applicable to your business:

A natural person is simply an individual operating in their personal capacity (i.e. they are not incorporated as a company. The definition covers individuals, individuals operating in a partnership where the partnership itself does not have a specific legal form (e.g. LLP’s), and similar businesses.

A legal person is an entity with a legal personality formed under the relevant laws that are capable of entering into contracts in its own name. For VAT registration purposes, the definition can include companies and other incorporated corporate entities such as partnerships with legal form (e.g. LLP’s), clubs, charities or associations, Federal UAE Government entities, Emirate UAE Government entities, foreign government representations (e.g. diplomatic missions) and international organizations and other entities with similar characteristics.

Points to be noted in this section

Branches are not legally distinct from the wider entity to which they belong. Therefore, registration will not be made in the name of a branch but in the name of the parent where it meets the relevant criteria. Even if you are operating via branches in more than one Emirate, only one VAT registration is required.

- Do you hold a Trade License in the UAE?: In UAE, Trade License usually refers to a business license, commercial license, professional license or any other similar license. In other words, it refers to any such license issued by an authorized issuing body in the UAE, including those in a UAE Free Zone.If you hold one or more Trade Licenses, you must select ‘”Yes” for this question and complete the additional information requested. Otherwise, please select “No” (this includes instances where a non-established business is required to register in the UAE).

- Are you registering mandatorily or voluntarily?: Here, you need to select whether you are required to register mandatorily or it is a voluntary registration. Please note, if you are applying for voluntary registration, you are required to register only when VAT is in force. To know more about VAT registration, please read “VAT Registration in UAE‘

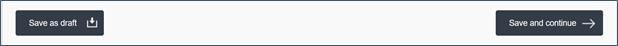

- Are you also applying to create or join a Tax group?: You can create a Tax group between two or more legal persons (each of which must be resident in the UAE) that are associated and which meet specific control criteria as prescribed by law.Please select ‘YES’ if you intend to create or join a Tax group. Else, select ‘No’ and proceed.After furnishing the relevant details in ‘About the Applicant’ section, you need to click ‘Save and continue’ to proceed to the next section. If you wish to re-visit the section later and complete, you can save the details in the draft mode by clicking “save as draft’.

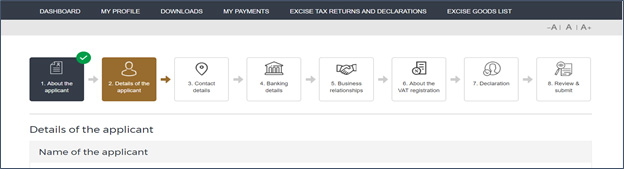

Details of the applicant

In this section, you need to capture the following details:

- Name of the applicant

- Identification of the applicant

- Details of the Manager of the business (CEO or equivalent).

Let us discuss these in detail.

- Name of the applicant: Here, you need to capture the legal name of entity both in English as well as in Arabic as shown below. If you are a natural person, you need to capture your full name. If you are a legal person, you need to mention the name under which your company has been incorporated. If you have a UAE Trade License, you will find your legal name listed on the license.

Also, if your trade name is different from the legal name of the entity, you need to furnish the details of the trade name. A trade name is a name under which a person conducts business, other than its legal name. For instance, a trade name may be the ‘Operating Name’ of the business.

Points to be noted for furnishing the details in the above section

- The legal name along with the trade name furnished in this section will appear on your registration certificate. Thus, care and caution need to be taken while furnishing the legal entity name and trade name.

- Since, the details of legal entity name and trade name need to be provided in Arabic, it is recommended to seek the assistance of a recognized translator. The Federal Tax Authority will not be assisting you with the translation of any information required for applying VAT registration.

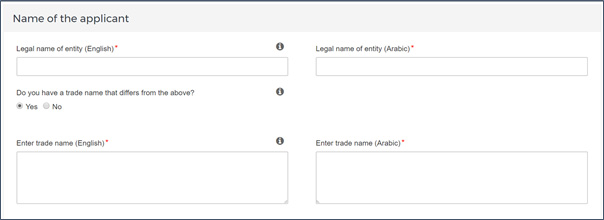

- Identification of the applicant

Here, you need to capture the details of all the trade licenses which are registered under the legal name of the entity as shown below:

Steps to fill the details of trade license in VAT Registration Form- In ‘Select the name of the authority that issued the Trade License’, you need to select the authority who had issued the trade license. A list of UAE Trade Licensing authorities is provided as a drop-down list on the form. You need select the relevant authority.

- Next, mention your Trade License number. You will find this number on your Trade License. It is also known as a registered number.

- In ‘Select Trade License expiry date’, mention the expiry date of your trade license.

- After providing all the above details, in ‘Upload scanned copy of Trade License’ you need to upload a scanned copy of your trade license as evidence which will be verified by the FTA. The accepted file types are PDF, JPG, PNG and JPEG and each file size should not be more than 2MB

- Verify the details furnished and save the details by clicking “Save Trade License’ option.

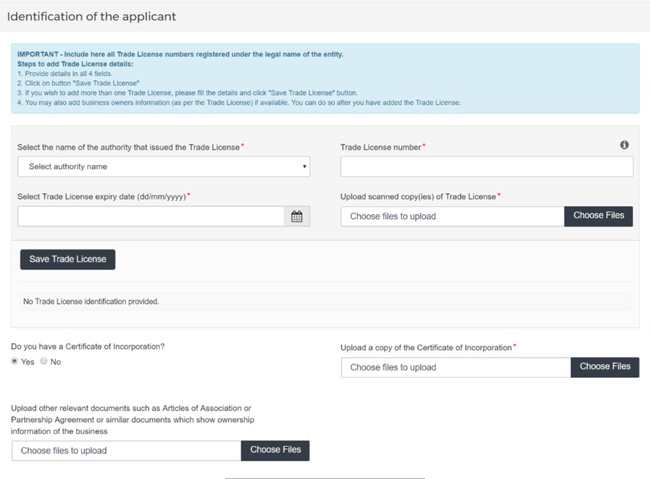

- Once after saving the details of Trade License, you will be asked to furnish the owner’s details as shown below:

- To add the owner’s details, click “Add Owner Details’ and furnish the information as shown below:

- The above fields are self-explanatory but ensure that the information about each and every owner is included along with scanned copy of trade license as evidence for FTA verification. If your Trade License(s) do not include information of all the owners, you must submit additional supporting documents by providing the details as requested.

- Next proceed to provide the details of Certificate of Incorporation, if applicable to you. For your information, a Certificate of Incorporation is a legal document relating to the formation of an entity which has been incorporated. It is a license to form a corporation which is issued by a government or, in some jurisdictions, non-governmental entities.

If applicable, you mention ‘YES’ under ‘DO you have certificate of Incorporation’ and upload the scanned copy of the certificate for FTA Verification. - The option ‘Upload other relevant documents‘ is not applicable, if you have already uploaded the scanned copy of Trade License or Certificate of registration. This is applicable to businesses who neither have a UAE Trade License nor a Certificate of Incorporation. In such a case, you have to upload another relevant document such as:

- Articles of Association

- Partnership Agreement

- Any other Similar documents which show ownership information about the business

- Club, charity or association registration documents and supporting evidence (applicable if you selected “Legal person – Club, Charity or Association”)

- A copy of the Decree (applicable if you selected “Legal person – Federal UAE Government Entity” or “Legal person – Emirate UAE Government Entity”)

- Other relevant documents such as documents providing information about your organization, including its activities and size (applicable if you selected “Legal person – Other”)

- A scanned copy of the Emirates ID of the owner or a scanned copy of the passport of the owner (applicable if you selected “Natural person Other”)

- If you have more than once Trade License under legal entity name, all the instances of trade license need to be added.

- To add more than once trade license details, first, you need to save the trade license and add another.

- Ensure that all the relevant documents as applicable are uploaded for FTA verification.

Depending on the basis on which you are applying for VAT registration, you need to upload the relevant documents. - If you have more than once Trade License under legal entity name, all the instances of trade license need to be added.

- To add more than once trade license details, first, you need to save the trade license and add another.

- Ensure that all the relevant documents as applicable are uploaded for FTA verification.

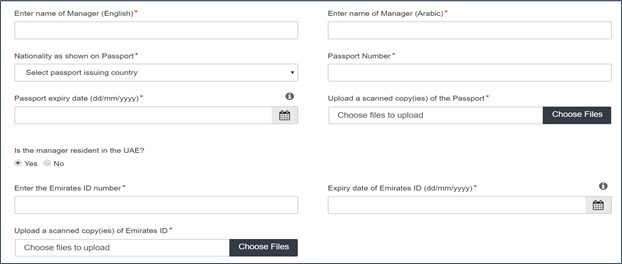

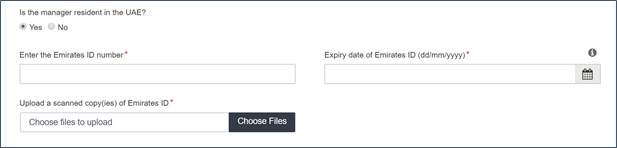

Details of the Manager of the business (CEO or equivalent)

As shown in the below image, you need to provide the details of manager or CEO or any other equivalent person who is in charge of the business.

Steps to furnish details in the above section:- In ‘Name of Manager’, you need to mention the name of the manager of the business as indicated in the Trade License. If no manager is listed in the Trade License, please include details of the CEO or equivalent person in charge of the organization. The details to be captured in both English as well as Arabic.

- Under ‘Nationality as shown on Passport’ select the nationality of the manager as shown in his passport.

- Next mention the passport number, passport expiry date and upload the scanned copy of the passport of the manager.

- Under ‘is the manager resident in the UAE?’ select ‘Yes’ if the manager is a resident of UAE. If ‘Yes’, you need to provide the details of Emirate ID number, expiry date of Emirate ID and upload the scanned copy of Emirates ID as shown below:

After providing the details in all the sections under ‘Details of the applicant’ click ‘Save and Continue’ to proceed to the next section.

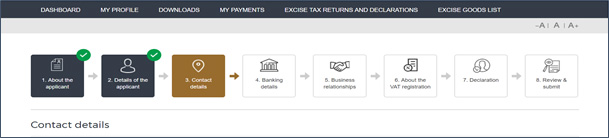

Contact details

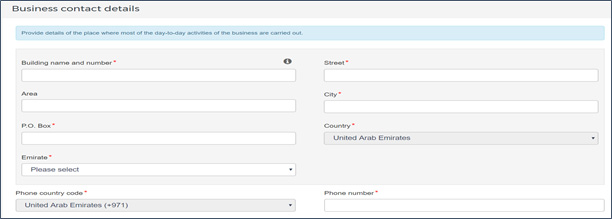

In this section you need to provide business contact details such as address and contact number as shown below:

The above details are self-explanatory however the following points to be considered while furnishing the business contact details:

- Avoid furnishing the details of another person’s address, for example, your accountant.

- If you have multiple addresses, please provide details of the place where most of the day-to-day activities of the business are carried out.

- If you are a foreign business applying to register for VAT in the UAE, you may choose to appoint a tax agent in the UAE. In such cases, you need to mention contact details of such tax agent.

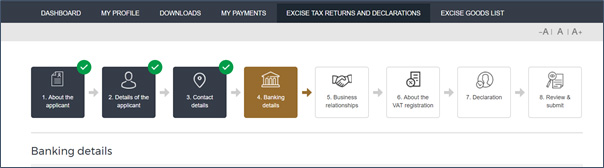

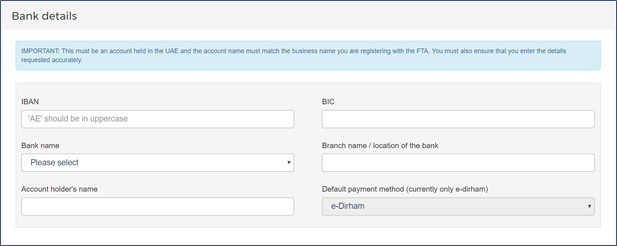

Banking details

In this section, you need to provide the details of you bank such as IBAN (Account Number), BIC (Bank Identifier Code) name of the bank, bank branch name, account holders name and so on. The details as shown in the image below needs to be furnished:

In this section, the details required to be furnished are self-explanatory however the following points are required to be noted while furnishing the details:

- The Bank Account must be held with a bank established in the UAE.

- The account name must match the legal name of the entity you are registering with the FTA.

- Ensure that the relevant details such as IBAN, BIC, Bank Name, and Account holder’s Name etc. are entered accurately.

- If you are in the process of opening a bank account, you must provide copies of any relevant correspondence received from your bank.

- Currently, e-Dirham is the only default payment option available and by default selected in online registration form.

- If you are unsure whether or not your bank provides the electronic payment facility, it is recommended to verify with your bank about the availability of electronic payment facility.

Business relationships

This section is applicable only if you or any of your directors or partners, currently involved in (or in the past 5 years have been involved in) any other business resident in the UAE, either individually or as a director or partner in that business.

You select ‘No’, if it is not applicable and proceed to the next section. If it is applicable, you are required to provide the details of the relationship with other businesses.

About the VAT registration

In this section, you need to furnish the details of your business activities, turnover, imports and exports and so on. This section is categorized into 6 sub-sections as mentioned below:

Let us discuss this in detail.

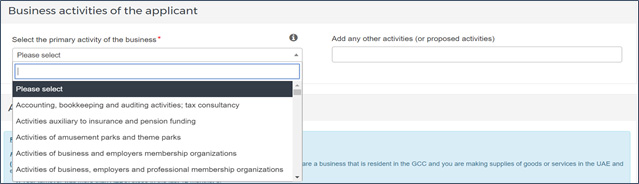

BUSINESS ACTIVITIES OF THE APPLICANT:

Here you need to choose from the drop-down list, that best describes your current or intended main business activities as shown below. In the next field “Add any other activities (or proposed activities)’, you select the other business activities (other than main activity) or the proposed activities.

ACTUAL OR ESTIMATED FINANCIAL TRANSACTION VALUES:

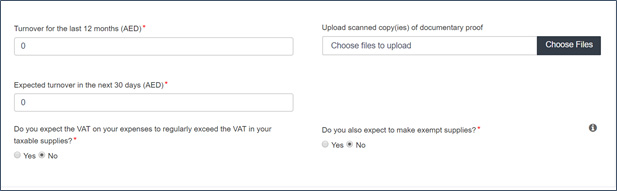

Here, you need to mention the details of your turnover as shown below:

- In “Turnover for 12 Months(AED)”, you need to mention the value of turnover which includes taxable supplies, zero-rated supplies, deemed supplies, and imported goods and services for 12 months. To know how to calculate turnover, please read ‘How to calculate the Turnover Threshold?’ Please note, that you need to report all the values in UAE Dirhams (AED) only.

- Next, you have to upload the document as evidence to justify the above turnover value. The documents such as Audit reports, audited or non-audited financial statements, and Self-prepared calculation sheets. Self-prepared which may include details to calculate the taxable/zero-rated supplies based on financial records or Revenue forecasts are generally accepted as evidence.

- In ‘Expected turnover in the next 30 days (AED)’ you need to provide the anticipated turnover for the next 30 days. The calculation of turnover is similar to the calculation of 12 months’ turnover.

- In ‘Do you expect the VAT on your expenses to regularly exceed the VAT in your taxable supplies?’. Select ‘Yes’ if your tax paid on purchases is higher than the tax collected on sales. Otherwise, select ‘No’. This information helps the government understand whether or not you will be in a position for VAT payment or refund.

- Next, Select ‘Yes’ in ‘Do you also expect to make exempt supplies?’ if you are making or expected to make exempt supplies.

IMPORTS AND EXPORTS:

You need to declare whether you are engaged in imports and exports as shown below:

If ‘ Yes, you need to mention whether these are imports from or exports to GCC member countries i.e. from imports from or exports to the Kingdom of Bahrain, Kingdom of Saudi Arabia, Sultanate of Oman, State of Qatar, and the State of Kuwait.

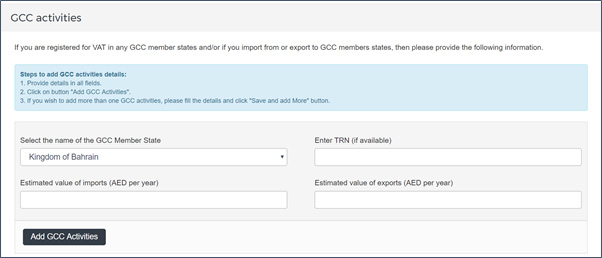

GCC ACTIVITIES

This section is applicable if you are registered for VAT in any GCC member states and in case of import from or export to GCC members states. You need to provide the details as shown below:

The details to be provided are self-explanatory however the following points are to be noted while furnishing the details:

- In calculating the estimated value of imports for 12 months, do not include the value of any services unless they are directly related to moving goods (e.g. commission, freight insurance, etc.).

- If you intend to import from and/or export to more than once GCC Member State, then you must click the “Add GCC Activities” button.

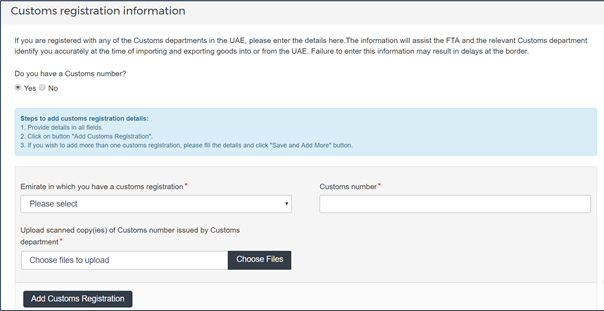

CUSTOMS REGISTRATION INFORMATION:

If you are registered with any of the Customs departments in the UAE, please enter the details as shown below. Otherwise, you can select ‘No’ and proceed.

As shown above, you need to select the Emirate from the list in which you have customs registration and customs number. Also, you have to upload the scanned copy of the customs number issued by the customs department for FTA verification.

This information will assist the FTA and the relevant Customs department to identify you accurately at the time of importing and exporting goods into or from the UAE. Failure to enter this information may result in delays at the border.

EXCEPTION FROM VAT REGISTRATION:

Businesses engaged in making only zero-rated supplies are allowed to seek exemption from VAT registration in UAE. If you are making only Zero-rated supplies, you can select ‘Yes’ under ‘Do you wish to apply for an exception from VAT Registration on the above’.

Remember, you will be not eligible for exemption from VAT registration if you make zero-rated supplies along with standard-rated supplies. Even if you opt for VAT exemption, you are still required to complete the remaining information on the VAT registration application form. The following supplies are eligible for zero-rated supplies in UAE:

- Exports

- Certain international transportation services

- Certain aircraft or vessels

- Certain investment in precious metals

- First supply of certain buildings

- Crude oil and natural gas

- Certain educational services and

- Certain health care services

Declaration

In this section, you need to provide the details of authorized signatory and communication preference such as Mode of communication and preferred language. Accordingly, this is categorized into 2 sub-sections:

A. Authorized Signatory

B. Communication Preference

How can BHMJ assist you?

BHMJ provides registration of Value Added Tax (VAT) services in accordance with the guidelines prescribed by Federal Tax Authority (FTA)